Never Waste a Crisis

The M&A opportunity for Private Equity

By Giovanni Donaldson and Rob Chapman

The next eighteen months will herald some of the most value creating M&A deals and investment opportunities of the coming decade. Across our corporate and private equity clients, businesses are thinking boldly about how to accelerate their digitisation. For those further ahead in their digital journeys, they are looking to double down on their advantaged positions. For those whose lack of real progress has been exposed, the only way forward is to “build back better”.

Economic downturns have always delivered unparalleled opportunities, as well as the real hardship. 50% of Fortune 500 companies were founded in a recession or bear market, including IBM, Microsoft, GE, Disney, FedEx and General Motors. M&A activity during downturns can lead to returns 30% higher than normal.

The current crisis is no different and creates an opportunity for PE and corporates to create value through bold M&A:

- While the crisis is accelerating digitisation, many technology innovators find themselves with substantially lower valuations as the fundraising imperative becomes more urgent and less easy.

- Unless COVID-19 has fundamentally and permanently destroyed their business model, these valuations are not caused by reductions in their fundamental value over the long-term.

- The competition for deals is likely to be lower as many potential corporate acquirers need to focus on cash conservation, as presaged by the reduction in CVC investment (and traditional VC is also showing signs of slowing)

Investors who slowed down in the last recession missed out on the best performing start-up cohort of all time, including AirBnb, Uber, Pinterest, Stripe, Square, Github and many more.

Before the current situation, the most prolific tech buyers were already private equity companies like Francisco Partners and Vista Equity (not, contrary to popular beliefs, corporates like Google and Facebook). Some PE houses are already seizing the opportunity: Apollo Global Management is investing more than $1 billion in ten distressed companies, and Ardian just raised $18 billion to acquire buyout stakes.

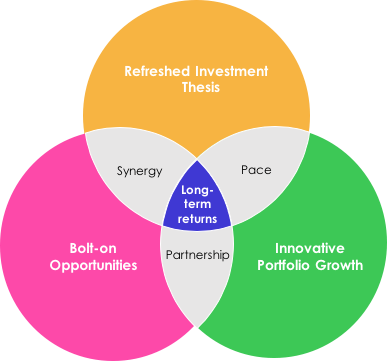

We’re supporting corporate development and PE teams to do three things urgently:

- Explore radical opportunities for growth. Consumer and business buying behaviours have changed radically. Every company, big or small needs to not just look at the impact on the core business, but evaluate what assets, skills, technologies, and partnerships they will need to launch alternate products and new business models to meet better these emerging customer needs in the post COVID-19 world.

- Understand the bolt-on landscape. Today’s tech start-ups and scale-ups, even those that are not yet profitable, represent potentially game-changing synergies, especially as industries start to undergo radical shifts. There are three crucial aspects to get right: (i) knowing what you want from a bolt-on — is it team, technology, product, or something else?; (ii) making your list of potential acquisitions now, so that relationships are in place even if you will wait 3–12 months for transactions; and (iii) being ready to act quickly even though it is far from certain that valuations are at their lowest.

- Know what good looks like. Investment theses developed three months ago may no longer be correct. There are two things to be re-thinking in the current climate: what industries are high-potential and what kinds of companies are best positioned for growth. It’s essential also to develop a strong view on which impacts (positive and negative) are cyclical vs structural for each.

At Founders Intelligence, we specialise in helping global corporates and private equity firms think about how they can accelerate growth through investment and partnership with technology companies. For PE specifically, we’ve helped multiple funds think through acquisition opportunities, shape investment theses, and deliver growth for portfolio businesses. For example, helping Centerbridge’s portfolio company APCOA to develop a new IoT-based operational model through partnership and investment with Get My Parking.

As part of the Founders Forum Group, we have access to the world’s leading network of tech founders, and have unique insight into which companies have the biggest potential.